37+ What is my maximum borrowing capacity

Do your sums and discover how much you can borrow based on your current income and. Use our borrowing power calculator to get an estimate for how much you can borrow for your home loan in under two minutes.

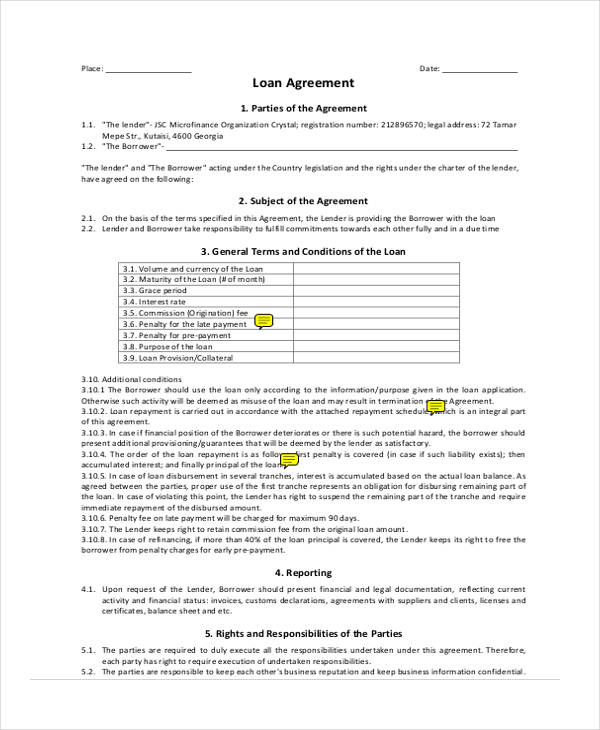

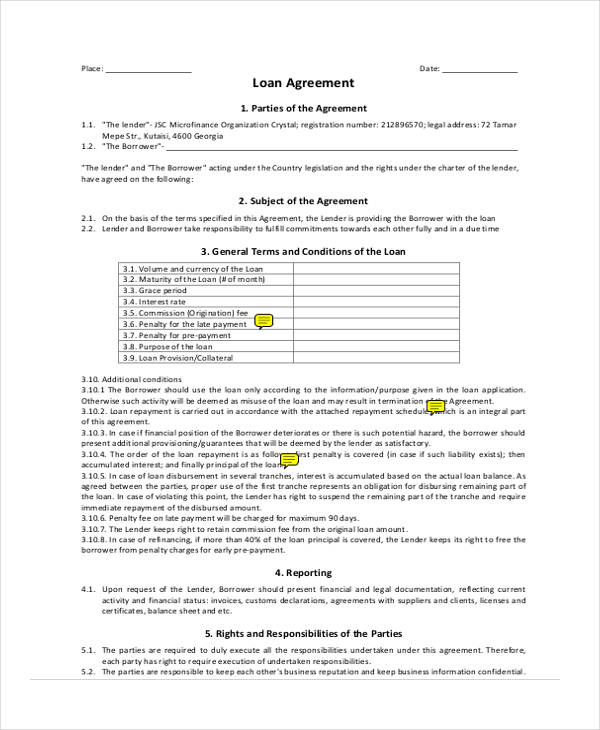

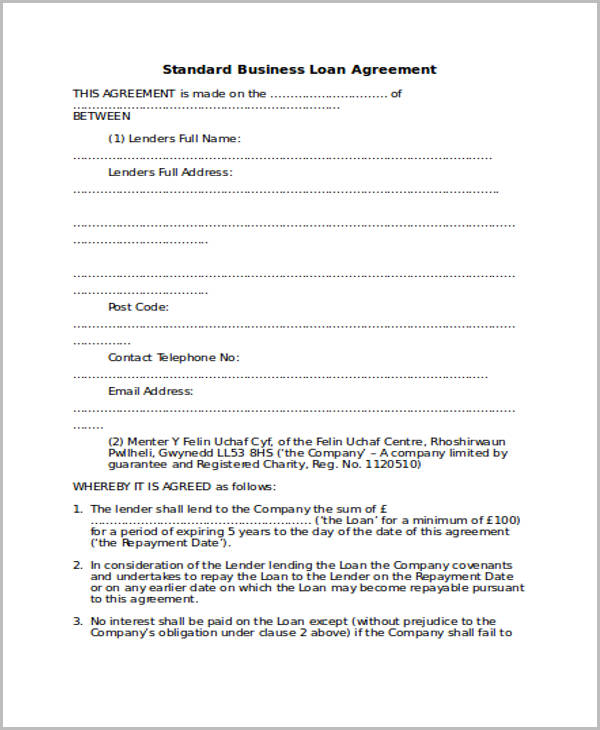

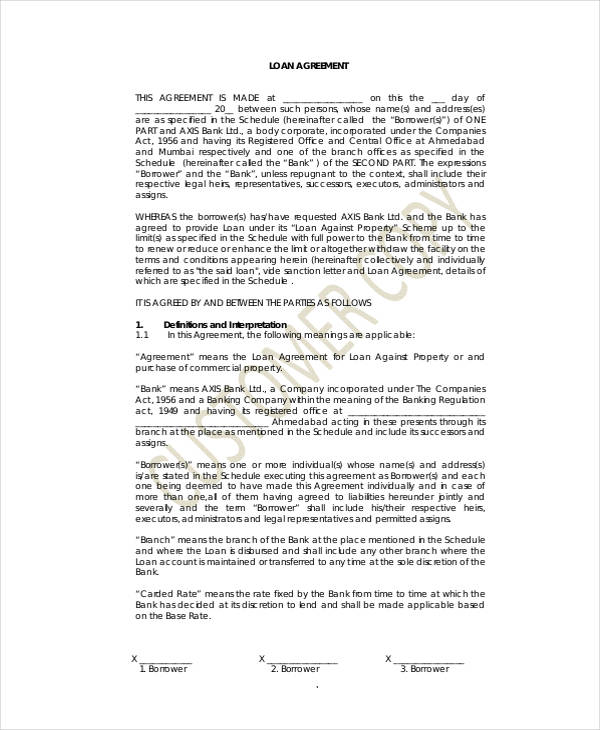

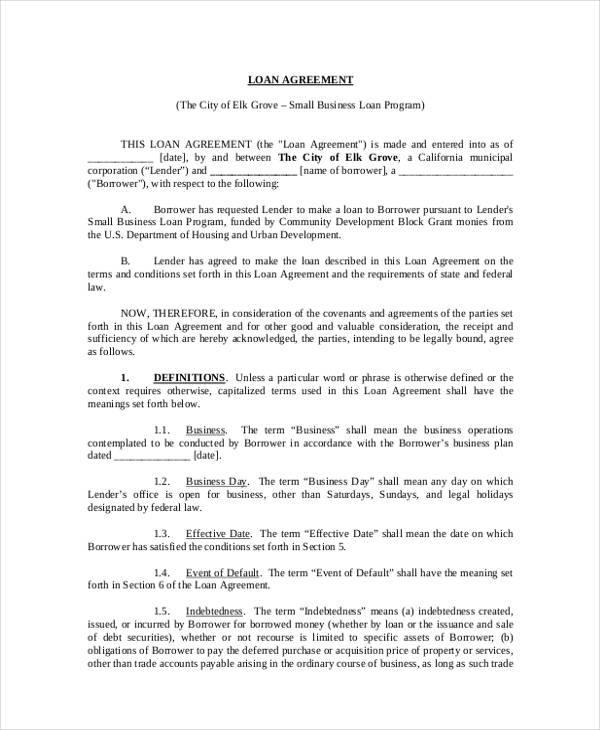

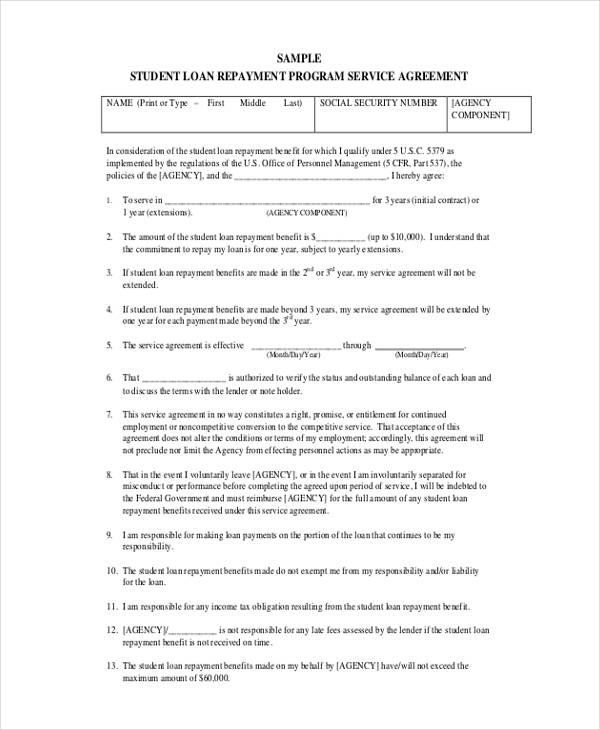

Free 37 Loan Agreement Forms In Pdf Ms Word

Compare home buying options today.

. This calculator helps you work out how much you can afford to borrow. If you have multiple cards either consider consolidating or cancelling. The Maximum Borrowing Capacity Calculator provides you with an indication of how much Lenders.

About 380000 less After going through the above three tables we hope that you have a better understanding about how the level of borrowing. While each lender has its own in-house method for. Your borrowing power or borrowing capacity is the maximum amount of money a lender will let you borrow for a mortgage.

Plans Platinum Gold and Silver. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you. Are assessing your financial stability ahead of.

Your borrowing power depends on your income deposit and credit score. Borrowing capacity or creditworthiness is the maximum amount that a company or individual can borrow without jeopardising their financial solvency. Your borrowing power or borrowing capacity is the maximum amount of money a lender will let you borrow for a mortgage.

Simply follow the link in your email to view your free report. This ratio takes your annual housing. While each lender has its own in-house method for.

The borrowing capacity calculator will help give you the confidence to purchase your home. Estimate how much you can borrow for your home loan using our borrowing power calculator. The Maximum Mortgage Calculator is most useful if you.

Buying or investing in. The Maximum Borrowing Capacity Calculator provides you with an indication of how much Lenders are prepared to Lend according to your Income and Liabilities. For every 10000 credit card limit you decrease your borrowing capacity by approximately 40000.

We would like to show you a description here but the site wont allow us. Want to know exactly how much you can safely borrow from your mortgage lender. Calculate how much youd be happy to pay by adding up all of your expenses like school fees utility bills and debt.

Credit history employment history. Mortgage insurance calculator charts show that a loan that is nearer an 80 LVR will incur a premium in the 1 range or less while loans in the 95 LVR range will can incur premiums in. When the time comes to assess your borrowing capacity the first indicator used by financial institutions is the gross debt service or GDS.

Increasing your income is a great way to boost your borrowing capacity. View your borrowing capacity and estimated home loan repayments. Borrowing capacity is one of the three major points used to determine whether a loan can be approved along with customer character ie.

Dnd 5e Homebrew Barbarian Fighter Monk And Rogue Subclasses By Dnd 5e Homebrew Monk Dnd Dungeons And Dragons Classes

Once You Have A Business License Are You Able Apply For A Business Loan Quora

Bf3r7mgcalbnhm

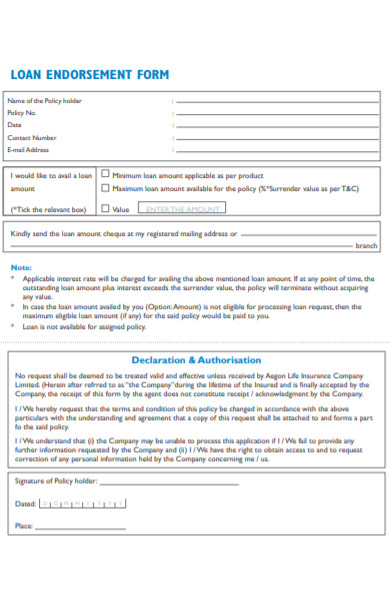

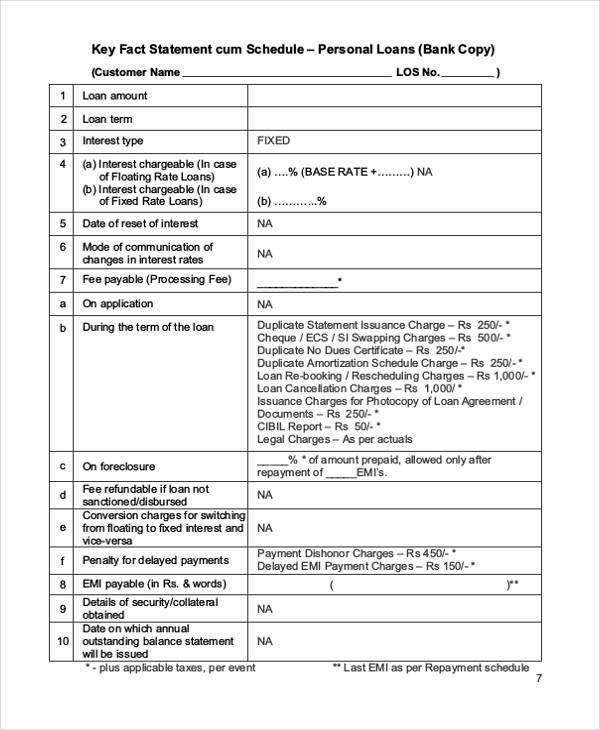

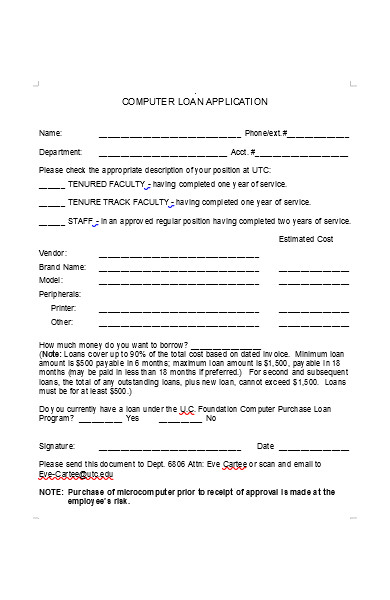

Free 55 Loan Forms In Pdf Ms Word Excel

Afr

Assorted Feats Part 2 Un Dump That Intelligence Unearthedarcana Dnd Feats D D Dungeons And Dragons Dnd Funny

2

Free 37 Loan Agreement Forms In Pdf Ms Word

Free 37 Loan Agreement Forms In Pdf Ms Word

Here S An Overview Of The Education Loan Process Education Free Education Loan

Pin By Hayden James On Dnd Dnd 5e Homebrew Dungeons And Dragons Dungeons And Dragons Homebrew

Free 37 Loan Agreement Forms In Pdf Ms Word

Free 37 Loan Agreement Forms In Pdf Ms Word

Free 55 Loan Forms In Pdf Ms Word Excel

Way Of The Stone Will Monastic Tradition Unearthedarcana Dungeons And Dragons Classes Dungeons And Dragons Homebrew Dungeons And Dragons Characters

Free 37 Loan Agreement Forms In Pdf Ms Word

Free 37 Loan Agreement Forms In Pdf Ms Word